Mine Loan Requirements

Mine loans are niche-loan markets that require special, expert investor funding. Generally financing producing mines, there are numerous options for mine funding.

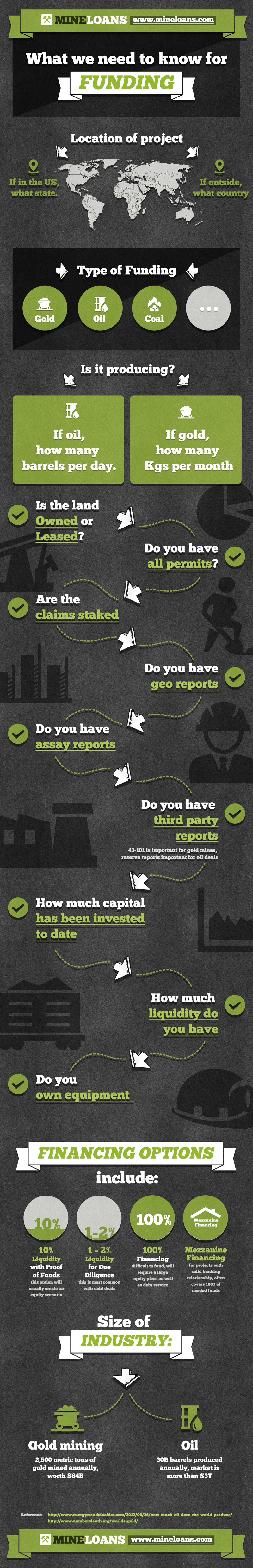

- Land Type – A question of great importance is if the land is owned or leased. Necessary permits and staked claims must be obtained, as this shows proof of mineral ownership. Legal rules require permission by property owners, as well as rules that govern mineral rights. National parks prohibit prospecting.

- Reports – Prospectors must have thorough mining records and geology reports. Prospecting should not be attempted without sufficient capital and geology reports that highlight positive mining results. An assay report is an analysis of chemical and physical properties, which helps determine the value of oil or gold mines. Third-party reports, such as 43-101, are standard disclosures for mineral projects and are required for oil projects in Canada.

- Investments – Investors have to known the full details of the mining project before investing their own capital funds. This can include the amount of monies that have been invested to date, prospectors’ liquidities, the amount of equipment owned (as capital), etc.

- Financing – Options vary on an individual basis, but generally include 10-percent liquidity, one- to two-percent liquidity, 100-percent financing and Mezzanine financing. The size of the industry also helps determine the amount of the loan. For example, 2,500 metric tons of gold annually is worth an average of $84 billion, while 30 billion barrels of oil annually is worth $3 trillion. These variables all help determine if Mineloans.com will offer funding for natural gas loans, oil well funding, coal mine loans and gold mine loans.